How To Donate

With your help we can make a real difference

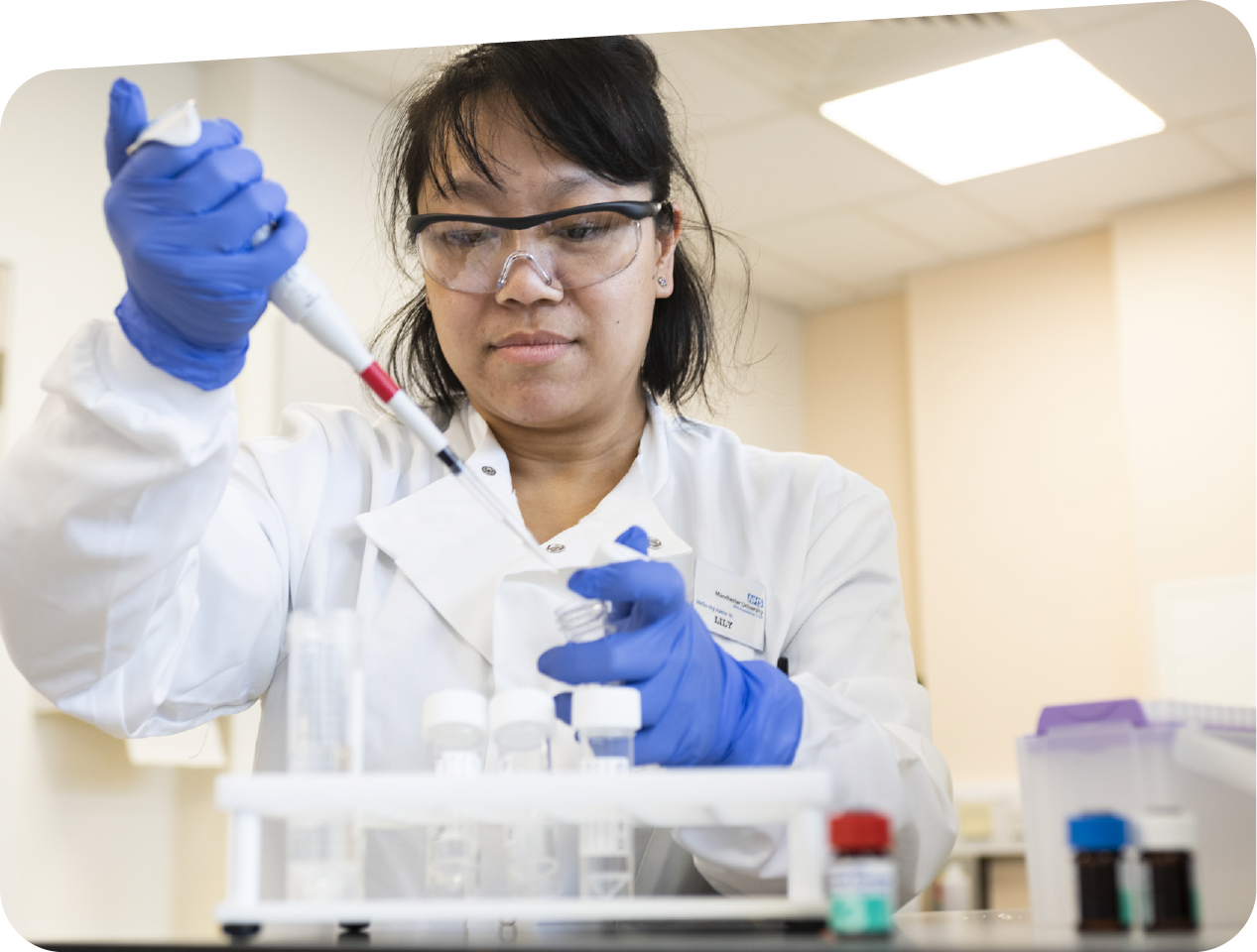

Every year our Trust cares for 2million patients from our local communities and beyond.

Your donation today will make sure we can continue to ensure every patient receives the best care possible in the very best hospital environment.

Whether you’re making a one-off or regular donation, paying in money from your fundraising or remembering a loved one with your gift you can make your donation online.

We’d love to know why you have chosen to support us, so please let us know when you make your donation.

You can also donate by sending a cheque to our office or by requesting our bank details to make a direct transfer. For more information on these donation methods, please read our FAQ section.

Regular Donations

Setting up a regular donation is a great way of showing your continued support for our hospitals. And there are a number of simple ways you can do this:

- 1. Set up a recurring gift on our online donation form

- 2. Download our Direct Debit form, complete and return to us by email or post

- 3. Set up a monthly gift through your payroll

Maximising Your Donation

If you are a UK taxpayer, your donation may be eligible for Gift Aid. This means we can claim back tax on your donation amount from HMRC, increasing your donation at no extra cost to you.

If you would like us to claim Gift Aid on your donation, please tick the Gift Aid declaration box when you donate online. You can also complete our Gift Aid form which allows us to claim Gift Aid on any donation you have made in the past four years, as well as all future donations you make.

FAQs

See all FAQs

You can set up a direct debit to leave a regular gift to the charity by completing our direct debit form and returning it to us using our freepost address below.

FREEPOST RLZB-SURH-BASX

Manchester Foundation Trust Charity

Cobbett House

Oxford Road

Manchester

M13 9WL

The Direct Debit Guarantee:

- The Guarantee is offered by all banks and building societies that accept instructions to pay Direct Debits

- If there are any changes to the amount, date or frequency of your Direct Debit the organisation will notify you (normally 10 working days) in advance of your account being debited or as otherwise agreed. If you request the organisation to collect a payment, confirmation of the amount and date will be given to you at the time of the request

- If an error is made in the payment of your Direct Debit, by the organisation or your bank or building society, you are entitled to a full and immediate refund of the amount paid from your bank or building society

- If you receive a refund you are not entitled to, you must pay it back when the organisation asks you to

- You can cancel a Direct Debit at any time by simply contacting your bank or building society. Written confirmation may be required. Please also notify the organisation.

For every £1 we receive, 25p is spent on the charity’s operational and fundraising costs and 75p directly supports our hospitals, patients and staff.

If you donate or pay money in online, you will receive an email confirmation. To keep costs down, we only send postal acknowledgements when they are requested. If you would like a postal thank you letter, please contact us.

Gift Aid allows us to make your donation go even further. All personal donations qualify, be it large or small, one off or regular.

If you are a UK tax payer we can claim back the tax you have already paid on your donations. The extra income comes straight from the government, so you can increase your donations at no cost to yourself. Please note that any Gift Aid we are able to claim will be treated as an unrestricted donation to our general fund.

You can complete a Gift Aid declaration here and return it to our office:

Manchester Foundation Trust Charity

Citylabs 1.0

Maurice Watkins Building

Nelson Street

Manchester

M13 9NQ

Payroll giving is an efficient way to support our charity as your donation is made before tax through your payroll provider so it will cost you less to donate. For example, if you are a lower rate tax payer, a donation of £10 through your payroll will cost you £8.

To find out if you can support us in this way, ask your employer if they are part of a payroll giving programme. If they are, you can make a donation from your salary each month to our charity.

We know that our supporters like to gift items to our hospitals, particularly during celebrations such as Christmas and Easter. However, these gifts are often not suitable for all of our patients which means many are left out. We always ask that donors consider making a cash donation instead as this will ensure you are supporting our patients all year round and helping us to make the biggest possible impact for them.

If you do decide that you would like to donate gifts to our hospital, you can contact us at charity@mft.nhs.uk or on 0161 276 4522 to find out more about the process. Please note that they must be brand new and in their original packaging – due to health and safety, we are unable to accept second-hand or homemade donations.

Stay in the loop

Let’s keep in touch! Sign up here to receive the latest news about charity events and projects, and how you can help, straight to your inbox.